The FBI created its own cryptocurrency company and crypto token in order to bait fraudsters who would make fake trades in order to boost the price before cashing out, according to a press release from the U.S. Department of Justice. The FBI operation, dubbed Operation Token Mirrors, was unprecedented in the crypto space and 18 individuals and entities have been charged over their alleged fraud and manipulation in indictments announced on Wednesday.

Three firms, ZM Quant, CLS Global, and MyTrade, allegedly offered their services to engage in what’s called wash trading of the FBI crypto token, along with about 60 other coins, to make it appear that there was tremendous interest. A fourth firm, Gotbit, allegedly engaged in similar wash trading but didn’t trade the FBI’s dedicated token. The wash trades were made using “multiple trading bots,” according to the DOJ, which have since been deactivated, and at least $35 million in crypto has been seized.

The crypto company and token created by the FBI was called NexFundAI and was built on the Ethereum blockchain. The token had a dedicated website that looked identical to any of the other sites created for cryptocurrencies that are created every day, but it now includes a banner at the top that reads, “This website was created at the direction of the Federal Bureau of Investigation as part of an investigation into cryptocurrency fraud and market manipulation. For more information, please click here.” The link for “click here” directs visitors to the DOJ press release about the indictments.

The indictments include Telegram and WhatsApp chats between the alleged fraudsters, along with the memes and GIFs they were sharing about their activity.

The indictment against CLS Global’s Andrey Zhorzhes also includes quotes from a video chat he had with the FBI (with the agency appearing under the guise of NexFundAI), where Zhorzhes explained how his company’s services work:

- “The thing that we can help with is volume creation. We can help with volume generation so you guys are able to meet exchange requirements, if you are applying for a tier 1 exchange.”

- “We have an algorithm that … basically does self-trades, buying and selling, and the only expenses you have are the gas fee and the exchange fee.”

- “We do that from multiple wallets so it’s not visible … it looks like organic buying and selling that is happening … so it does not look like an algo[rithm] is trading, because if it is obvious, then it doesn’t make much sense.”

- “The idea of volume generation is creating some volume on the decentralized exchange so the token looks organic and looks live and people get interested in trading it.”

- “We do that by transferring the funds into multiple wallets, that could be as many as you guys wish . . . from which we do the buying and selling . . . and generate some desired number for you. We decide some number we wish to generate per day . . . can be 100,200,300k, doesn’t matter, and then we generate these number[s]… on a 24-hour timeframe.”

- “It’s very hard to track…. We’ve been doing that for many clients.”

- “I know that it’s wash trading and I know people might not be happy about it.”

“What the FBI uncovered in this case is essentially a new twist to old-school financial crime. ‘Operation Token Mirrors’ targeted nefarious token developers, promoters, and market makers in the crypto space,” Jodi Cohen, Special Agent in Charge of the FBI’s Boston Division, said in a press release. “What we uncovered has resulted in charges against the leadership of four cryptocurrency companies, and four crypto ‘market makers’ and their employees who are accused of spearheading a sophisticated trading scheme that allegedly bilked honest investors out of millions of dollars.”

“The FBI took the unprecedented step of creating its very own cryptocurrency token and company to identify, disrupt, and bring these alleged fraudsters to justice,” Cohen continued.

Of the 18 individuals and entities charged by the DOJ, so far four have pleaded guilty, and another has agreed to plead guilty. Three other defendants in Texas, the UK, and Portugal have been apprehended this week, according to the agency.

Those charged so far include:

- Aleksei Andriunin, Fedor Kedrov, Qawi Jalili, Gotbit Consulting LLC (Gotbit)

- Riqui Liu, Baijun Ou, ZM Quant Investment LTD (ZM Quant)

- Andrey Zhorzhes, CLS Global FZC, LLC (CLS)

- Liu Zhou, MyTrade MM

- Manpreet Kohli, Haroon Mohsini, Nam Tran, Max Hernandez, Russell Armand, Vy Pham, Saitama LLC (Saitama)

- Robo Inu Finance (Robo Inu)

- Michael Thompson, VZZN

- Bradley Beatty, Lillian Finance LLC (Lillian Finance)

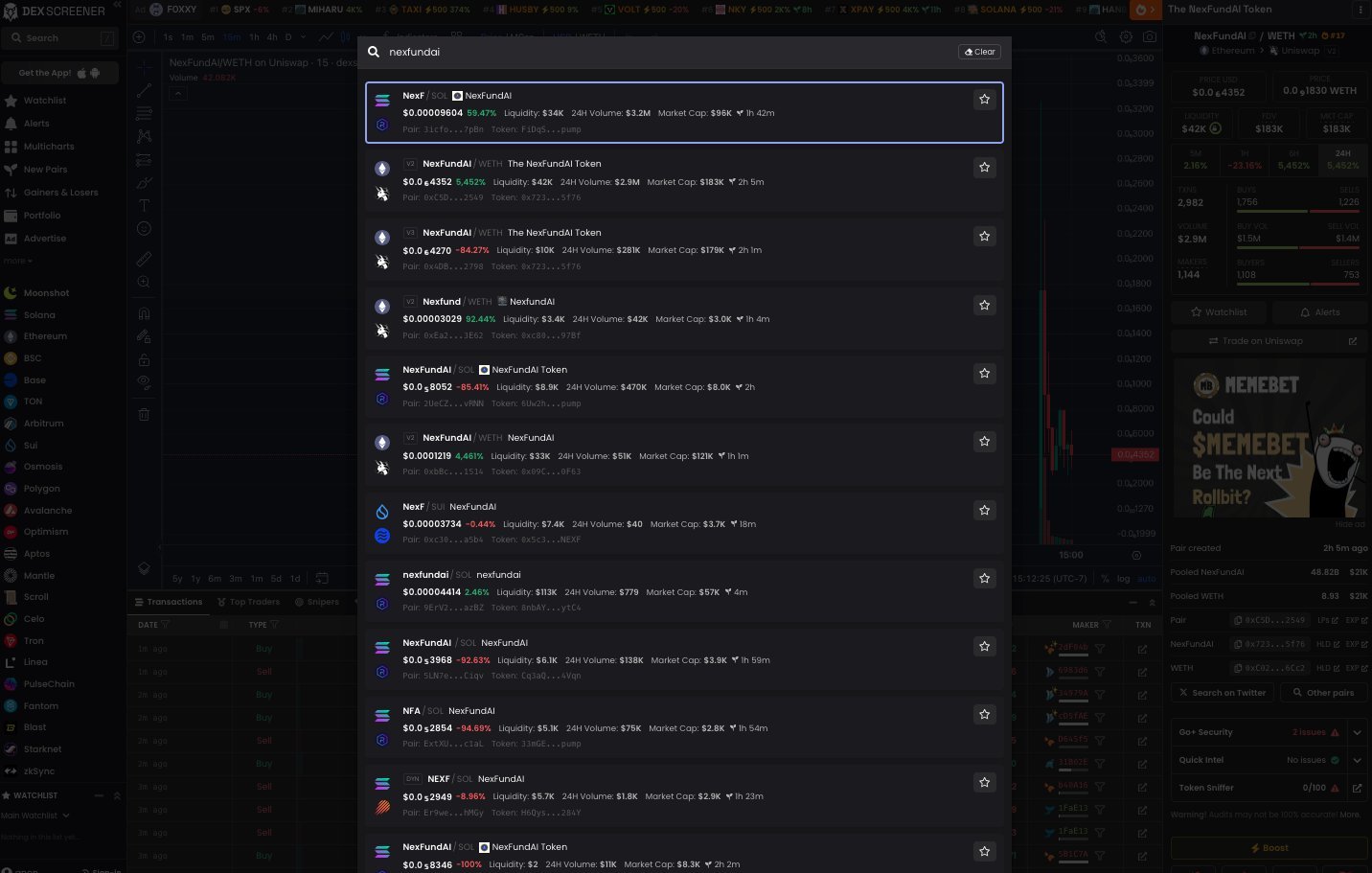

Will these charges deter future scammers? That remains to be seen. But in the two hours after the indictments were announced Wednesday, dozens of new tokens with the name NexFundAI were created, according to a search of DexScreener.

We’re going to guess the crypto space will continue to be a Wild West of finance with more scammers than anyone can properly count. Anyone who bought or sold tokens from any of the companies being charged, including the FBI’s own token, is encouraged to contact the FBI as a potential victim of a crime. But crypto fans are pointing out on social media that it’s pretty rich for the FBI to create a scam token and then implore the people harmed by that same scam to seek help from the FBI.

Read the full article here